The moment we mention financial reports, most people run for cover. They conjure images of high school math whiteboards (or blackboards!), the Stock Exchange and loads of percentages and calculations.

While financial reports may sound daunting, they are a necessary part of running a successful business. Financial reports tell you the health of your business and enable you to make informed business decisions.

An olympic athlete may be naturally talented and fast. This could get someone into the competitive arena. However, when other competitors join, with well-informed coaches, the naturally talented athlete can quickly end up coming last. Measurable data allows athletes to hone in and improve their weaknesses, turning them into strengths which turns into success.

How Often do I need to Run Reports?

In the past, businesses had their financials prepared annually, and their reports were run annually for most small businesses. Larger businesses had their own internal accountants running monthly reports.

Now, we all have access to real-time in-the-cloud accounting systems. There is no reason why a business owner should need to wait until the end of financial year to find out if they made a profit.

If you don’t have a bookkeeper helping you, get one. They will ensure your data is accurate and kept up to date.

At the very least, a small business should run basic reports once a quarter. We would love to see every business owner run their reports monthly. Ensure your bookkeeper has finished with the quarter or month and then have a look at those reports. A good bookkeeper will send you some basic reports each quarter or month.

Which Reports do I need and what do they tell me?

Lets start with some basics. Here is a list of basic reports you will want to see. If the idea of reports terrifies you, just look Profit and Loss

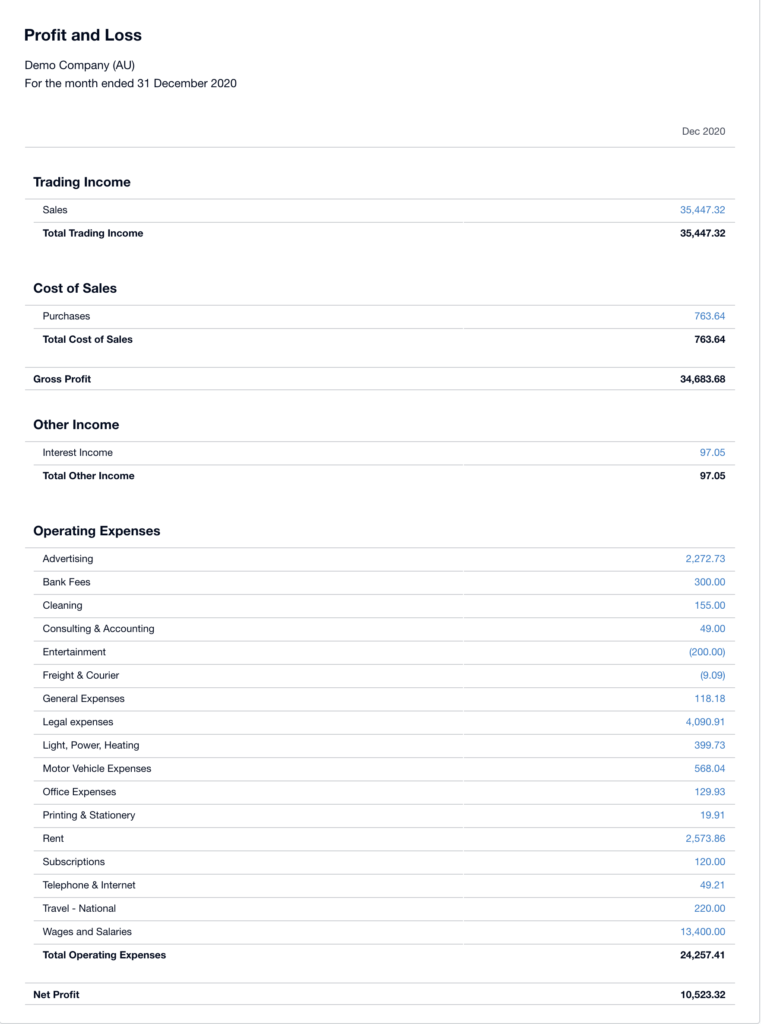

Profit and Loss Report

The Profit and Loss (P&L) report tells you income, less expenses for a period of time and the resulting profit or loss

Remember that a P&L is based on what you invoice and the bills that are entered. It is not based on what you have spent or received (eg. you could have $100,000 invoiced but have only received $5,000 so far. Your overall profit could be $20,000 if your expenses totalled $80,000 but you may not have $20,000 in the bank as this has not been fully received yet)

In this sample report, the business has invoiced $35,447.32 for the month of December. The total expenses were $24,257.41 ($763.64 + $24,257.41) plus Interest income which would leave a net profit of $10,523.32

This report is very helpful as shows that the business is operating in a positive direction. However, if cashflow is bad or debtor days are long, the business owner could run out of money soon.

The Profit and Loss does not include cash taken by the owner, PAYG withholding, Super or GST owed etc. so is quite basic and must be read in conjunction with other reports:

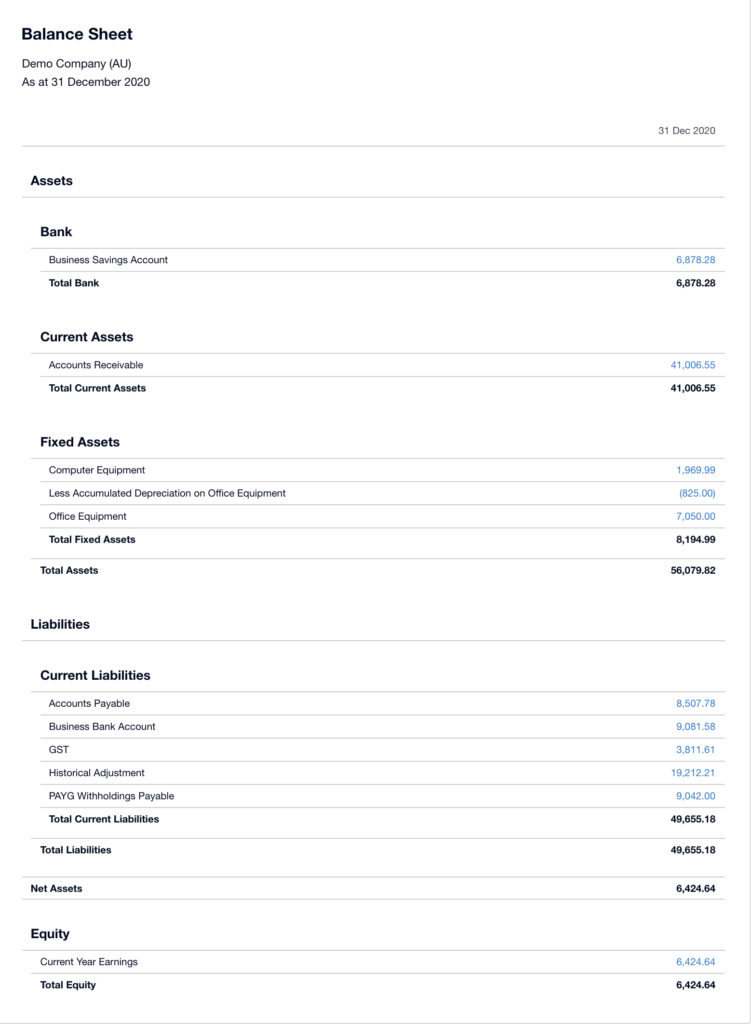

Balance Sheet Report

As the Profit and Loss (P&L) report tells you trading income less expenses, the Balance Sheet advises you about your assets (what you own and are owed) less your liabilities (what you owe others)

It is a summary of your business worth and is very useful if your bookkeeper/accountant keep it up to date. Let’s have a look at a sample Balance Sheet

We can see here that the business has $6,878.28 in the bank and is owed $41,006.55 by its customers (Accounts Receivable Invoices). With some fixed assets, the business owns a total of $56,079.82

However, when we look at the liabilities (what the business owes), we can see that there is $8,507.78 in Accounts Payable (bills to be paid), some debt in the business account (possibly an overdraft), some GST owed to the ATO, and some PAYG Withholding owed to the ATO. The historical adjustment can be ignored for now

Current year earnings is the total Profit and loss for the FY to date

The Equity is the financial worth of the business

We like to look at the balance sheet as it shows what you owe and are owed and can help you project your cashflow

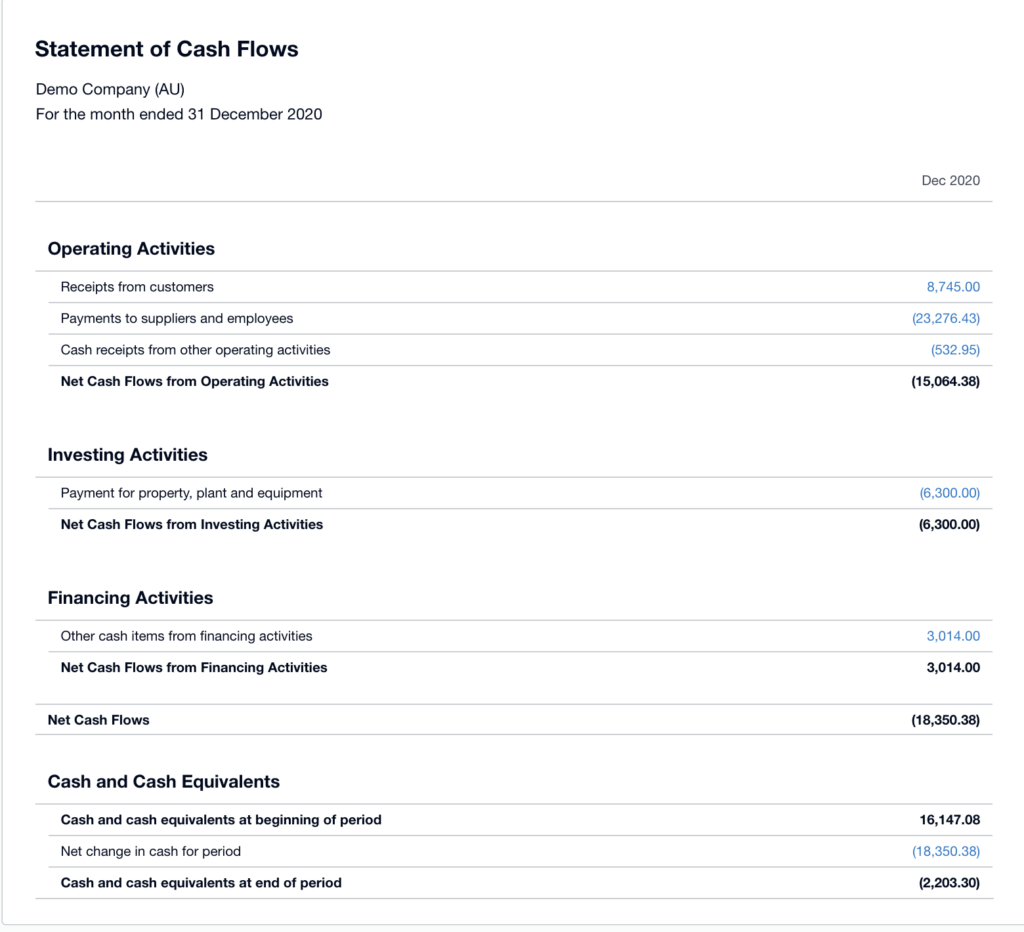

Cashflow Report

Possibly one of the most helpful reports in a business as poor cashflow can destroy a business

The Cashflow report is a bit like combining the P&L and the Balance sheet together.

Just as the P&L indicates our invoiced and billed amounts, the cashflow report shows us what we actually paid for and received (it is cash in and cash out).

It also shows what we owe to the ATO and have paid in loan repayments, director drawings etc.

Your P&L could show a profit of $10,523.32 (as our demo report shows) but you have no money in the bank. Where did all that profit go?

The Cashflow report will explain what you have done with all the cash. Lets see the same month in a cashflow report

Although this business made a profit, they paid out more to suppliers than they received from customers. They also paid off some loans for assets which meant they had spent $2,203.30 more than they earnt. This business needs to monitor the cashflow report and their debtor days more closely

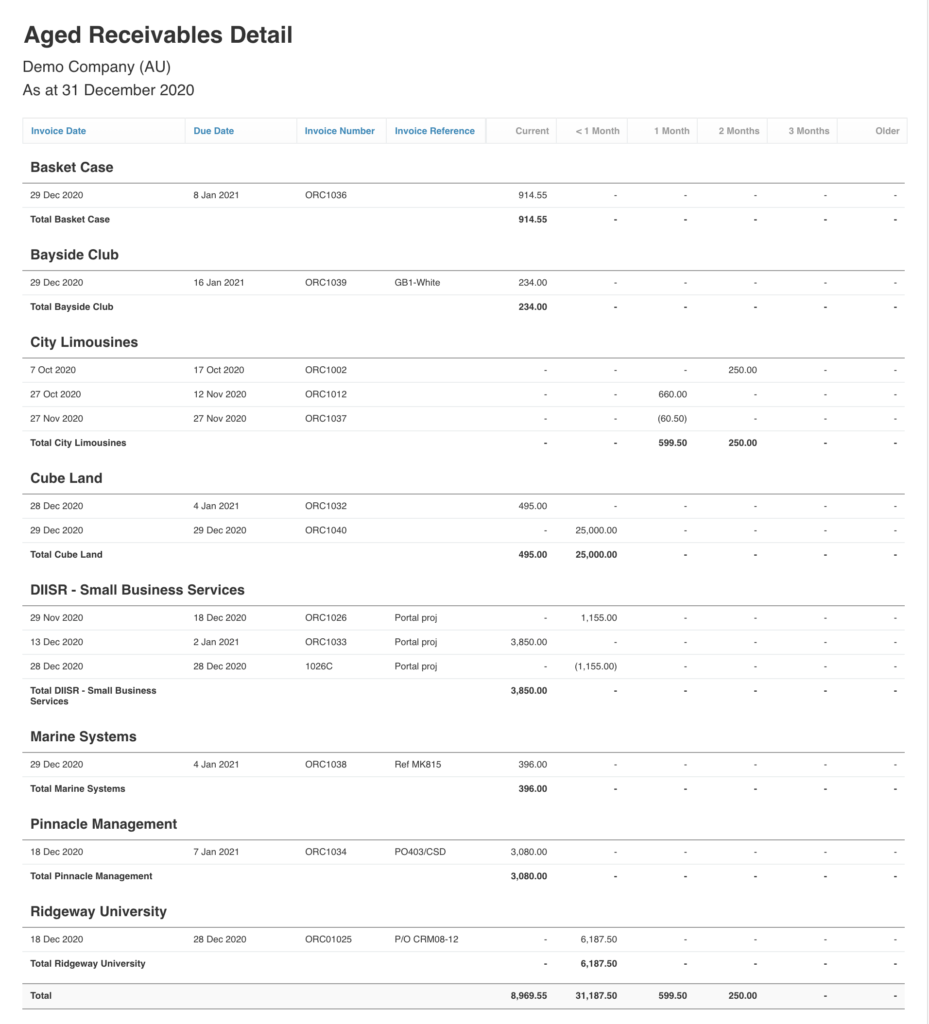

Accounts Receivable

The Accounts Receivable report is a listing of invoices that have not been paid by customers. It includes current and overdue invoices

You should run this at least every month and use it to follow up on overdue customers. Reducing your debtor days will significantly improve cashflow.

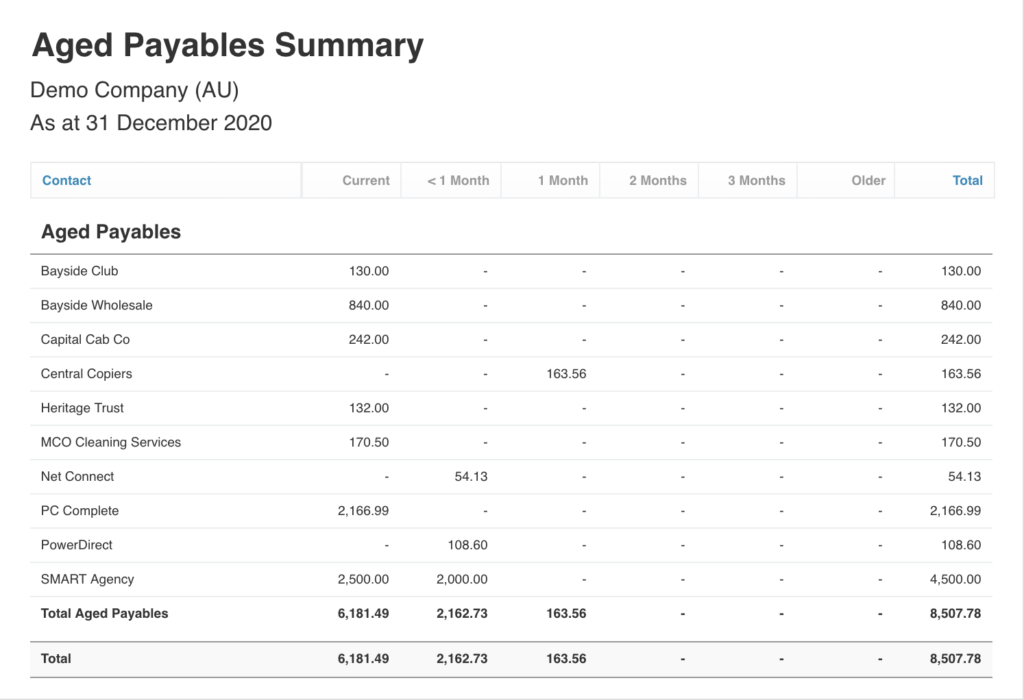

Accounts Payable

The Accounts Payable report is a listing of bills that have not been paid to suppliers. It includes current and overdue bills

It will help you plan your cashflow over the coming months as long as you have entered these bills into your accounting system

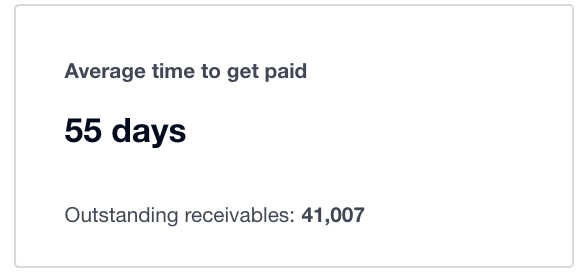

Debtor Days

This tells you how long it takes the average customer to pay you. You should monitor this and try to reduce the number of average days so the money is in your bank account, improving cashflow

So many business owners have no idea what is going on and only check the bank balance. Your bank balance is not a good indicator of business health and will only leave you with doubt.

If you work on gaining an understanding of these basic reports and run them regularly, your business will grow in health and stability. Seek help from your advisor if you need to and ensure you don’t fly blind when it comes to running your business.