Why is Cashflow so Important?

We’ve all heard the phrase ‘Cashflow is King’ in business but why is that true? Whether you are about to start a business, in the early days of running your business or have been at it for years, cashflow management is so important that if done well, you are free to grow, innovate and motivate.

Cashflow management done poorly can impede growth, tie up your mental creativity and even stop your business from operating.

Practical Ways You can Improve Cashflow Today

Click on each of these to expand and find out how you can improve cashflow for your business

1. Reduce Accounts Receivable ... How?

Perhaps the most obvious action is to reduce your debtor days and collect your outstanding invoices.

This is important because long debtor days = poor cashflow. Every wondered why big business take so long to pay their bills but are the first to ask for payment? They have discovered the secret to improving cashflow.

Believe it or not, many small business owners feel bad asking for payment, so they rely on their customers to ‘do the right thing’. This happens occasionally, but in most situations, the business owner takes a hit to cashflow.

Set up a regular and systematic plan for invoice reminders and stick to it

You may choose to set up automatic invoice reminders in your software system. These can be done in Xero. Your client will receive a new email each number of days overdue and you can customise each email. Eg. 7 days overdue may be a reminder, 21 days overdue may be a stern request, 35 days overdue may be a demand etc.

If you don’t use software reminders, engage someone (preferably other than the salesman or business owner) to email and call your overdue customers. The contact needs to be regular and systematic.

Ad hoc calls, and contact from the business owner asking for payment look unprofessional and usually result in late payment.

Think about your own suppliers. Which ones do you ensure you pay on-time every time? Is it the one that has the nice business owner that never calls or is it the one that will contact you 2 days after payment is due? No one likes to be called for payment and to avoid this, your customers will not only appreciate your professionalism, they will pay you faster.

Send monthly customer statements

It is important the customer knows you are professional and sending a statement each month in the first week of the month reminds them of the total amount they owe. Many big businesses will only pay on statement so don’t forget to email them out. Again, regularity is key

Negotiate better payment terms

Be a pre-emptive negotiator by always paying your accounts on time. It’s sets up a professional image and culture in the workplace.

If you have customers on long payment terms, they may tell you that all their suppliers are on 90 day terms. Rest assured, this is not true. Find out how you can negotiate better terms and sometimes the best way to find out is by simply asking. Speak to the decision maker and remind them of your great service, product and desire to keep them at the top of your supply chain.

You may need to do this more than once to get the point across.

If you have customers on long payment terms that won’t budge, avoid over-exposure to them and try to replace their income as soon as possible. Contact them regularly if their payment is overdue.

2. Accordion Panel

Merchant services are a must these days for almost every business. The days of expensive eftpos machines being the only answer are over. If you haven’t noticed, there are a plethora of options now for businesses:

Take Credit card payment linked to your invoices

Seen those invoices where there is a link to pay now? You can do this within your accounting software by linking up to a payment gateway service. These are fantastic. They allow the customer to decide which method of payment they will choose, and accept the corresponding fee. Some great products to look into are IntegraPay, Pinch, Stripe, Square, Paypal and eWay. Get in touch if you want more info on these.

Basically, you can use some of these products to allow your customer to setup regular direct debit payments from a bank account or credit card, pay a one-off invoice into your bank account or use their credit card or bpay or even take payment in person with a Square or Paypal reader.

Square and Paypal readers are great for tradies as you can link them up to your bank account and take a payment in person with someone as they tap their card. You can connect these to your mobile phone. So easy

All merchant services settle into your nominated business account and the fees are very low. If you have the right setup, you can do this with no fees to you and have them all pass on to the customer.

3. Set Up Your Business Bank Accounts Correctly

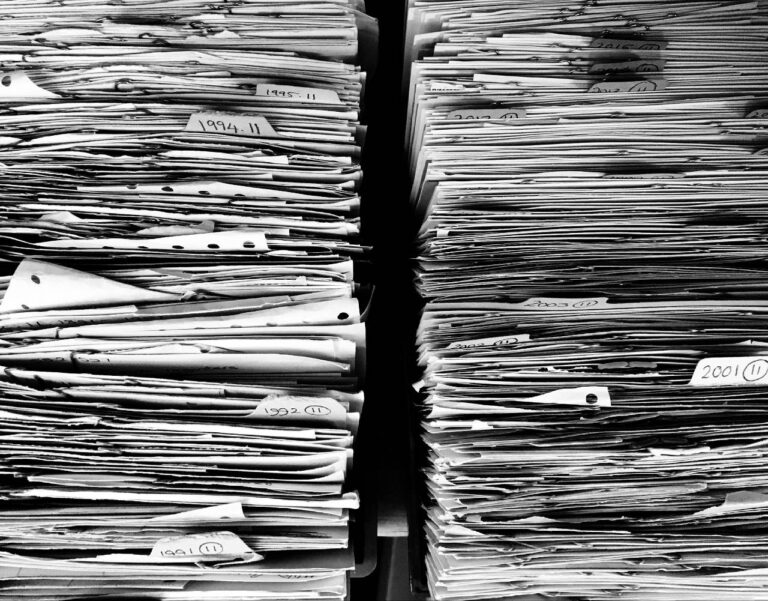

Small Business Insights for September 2019 in Australia – Xero

The statistics above represent data collected by Xero for Australian businesses in the month of Septermber 2019. How does your business compare?